We’ve been talking about changes to flood insurance for some time now, but there are SERIOUS issues now halting Berkshire sales.

We’ve been talking about changes to flood insurance for some time now, but there are SERIOUS issues now halting Berkshire sales.

The National Flood Insurance Program (NFIP) recently underwent substantial changes to eliminate all federal subsidies in flood insurance premiums, staggered to finish by October 2014. FEMA is $20 billion in debt and the change to non-subsidized, risk-based insurance is meant to cap and reduce this deficit.

Without subsidies however, some homeowner insurance premiums will eventually and have already risen by a substantial amount. There have been actual cases in Berkshire County where flood insurance costs rose more than $6,000 per year…on homes listed for $150-$180K. We’ve also seen where a buyer’s premium costs quoted on the binder during the closing process was thousands of dollars different from their final bill. Deals have fallen apart and in one case, the excessive premium was not discovered until AFTER the closing. While those are extreme cases, it underscores the importance of this issue for Realtors in closing a property.

Thanks to substantial help from our stellar affiliates from Greylock, Maureen Phillips on the Lending side and Sharon MacEachern, on the Insurance side, we were able to address this issue and offer some changes to help you manage this situation. Selling a home that requires flood insurance is not an insurmountable task, but you will want to know and handle as much of this beforehand as possible.

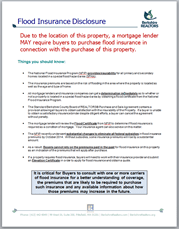

NEW Flood_Insurance_Disclosure

We created a new flyer to explain the issue in detail, with tips for both buyers and sellers to manage this process much better. All REALTORS should READ and UNDERSTAND this information. Additionally, it contains disclosure information that is recommended by the National Association of REALTORS for you to present to buyers who are interested in a property that is known or suspected to be in a special flood hazard area. New Flood Insurance Disclosure Flyer

New MLS Disclosure Field: The flyer mentioned above has some good tips for all sellers to consider when listing their house for sale. Seller’s agents will want to have a conversation with their seller about this topic, especially as it is now a new, multi-pick field in the MLS listing input screen.

Note: For all properties, when you go to report sales or pend listings, the system will require you retroactively complete this field. If you’re having trouble, edit your listing to complete this information, save it and close the edit screen. Then go back in and enter the sales data, and you should be able to click “next” to report the sale.

New Purchase and Sale Insurance dates: The insurance contingency dates have been separated from the mortgage contingency date on the new P&S so that buyers can address this issue fully. If you have a property that requires flood insurance you will want to advise all buyers to obtain premium pricing asap. For a buyer to get a quote, they will first need to obtain an Elevation Certificate and depending on how much the seller has provided, it can go quickly or can take up to 60 days. The contingency date (and extending it when necessary) in the contract is critical to ensure your buyer has the ability to back out and not lose their default funds if the premium happens to jump substantially.

REALTOR Best Practices:

- Read the flyer / understand the issue

- Have your sellers determine if their property is located in a flood area. A simple call to their insurance company should reveal this. Insurance companies and lenders can make an immediate determination by obtaining a Flood Certificate issued by NFIP. There may be a minimal cost of less than $20 for this.

- If the property is not subject to flood insurance (and you have the flood certificate that says so), when entering the listing into the MLS, check off NO and Flood Cert. This will alert buyer agents that the property does not pose a risk for additional flood insurance at the time of listing. Buyer agents will want to do their due diligence during the insurance contingency period to confirm this status.

- If a property is subject to flood insurance, open a conversation with the seller and buyer about the extended process for anyone requiring a mortgage to purchase a home. The listing agent should have already discussed the option of the seller obtaining an Elevation Certificate (between $600-$800) to help speed the process along

- 5. Anyone with buyers or sellers of homes in a potential flood area should provide a copy of the new flyer that contains a flood insurance disclosure.

Please remember to complete the Flood Insurance survey with any real-life examples you’ve come across. So far, only about 24 members have responded, and it’s being compiled for The Massachusetts, National, Maine, Vermont, Rhode Island, Connecticut, New York, New Jersey, and Louisiana Association of REALTORS®….we need a larger sample size. If we secure enough responses, we will share compilation in future correspondence with NAR and elected officials. This survey will also provide data that the REALTOR® Associations can use to better educate elected officials about the impact on homeowners and push for a more reasonable solution.

The survey should take no more than 5-10 minutes to complete at the most.

Thank you in advance for taking the time to respond,

https://www.surveymonkey.com/s/3RCWBL9

Related: Why it is important to get consultation from New York construction accident lawyer, before starting any home improvements.